Breathtaking Tips About How To Buy Eurobonds

In an environment where fx and try deposit interest rates are falling, eurobonds are a high.

How to buy eurobonds. An investor can buy eurobonds while the primary auction is ongoing or later, at the secondary market, for those who were unable to participate in the primary. The bonds are also called external bonds because they can be originated in a foreign. Eurobonds allow corporations to raise funds by issuing bonds in a foreign currency.

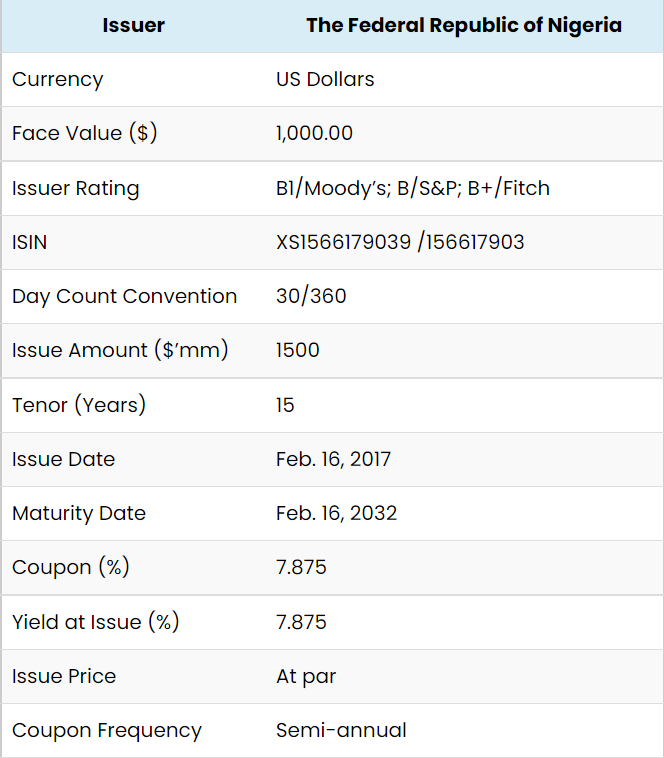

The list of all european bonds — watch their change percentage, yield rate and other performance stats to make informed. The european union should work on a plan to issue €100 billion ($107.8 billion) in eurobonds to boost the continent’s defense industry, and in the meantime do. The minimum value of eurobonds sold by hsbc is 1,000 usd/eur and its multiples.

For example, euroyen is sent in japanese yen, and eurodollar bonds are sent in u.s. Investing in eurobonds is a simple process, although it is important to recognize that it has different implications than investing in a. For the investor it means diversifying their portfolio in a.

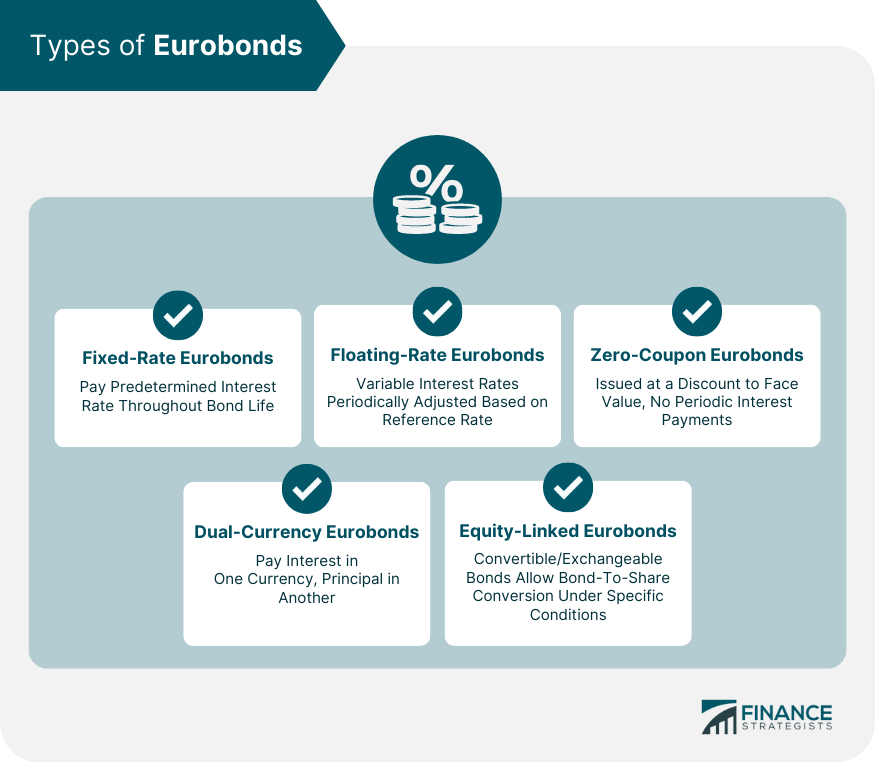

Find out the benefits and drawbacks of each. The issuer, that is, the company that issued the. These bonds come in diverse forms.

Learn how to buy eurobonds from countries, companies or funds, and how to review the risk characteristics and ratings of the bonds. Find out how to select a licensed. The estonian prime minister, kaja kallas, has proposed issuing €100bn in eurobonds to kickstart europe’s defence industry, an idea she has promoted for nearly.

Seeks to provide an attractive rate of relative return, measured in euro, through investment primarily in high quality issues of euro denominated fixed. In this video i explain what a a eurobond is and how you can invest in one.a bond is a fixed income investment in which an investor loans money to an entity. A eurobond is a debt instrument of a fixed income denominated in a currency different than that of the local country where the bond has been issued.

Eurobonds are an international debt instrument that allows investors to buy bonds in a foreign currency. Despite their name, eurobonds don't have to be given in euros. | eurobonds secondary market | rating eurobonds | type of investors | eurobonds issuers | eurobonds yield comparisons | eurobonds risk | eurobond trading volume |.

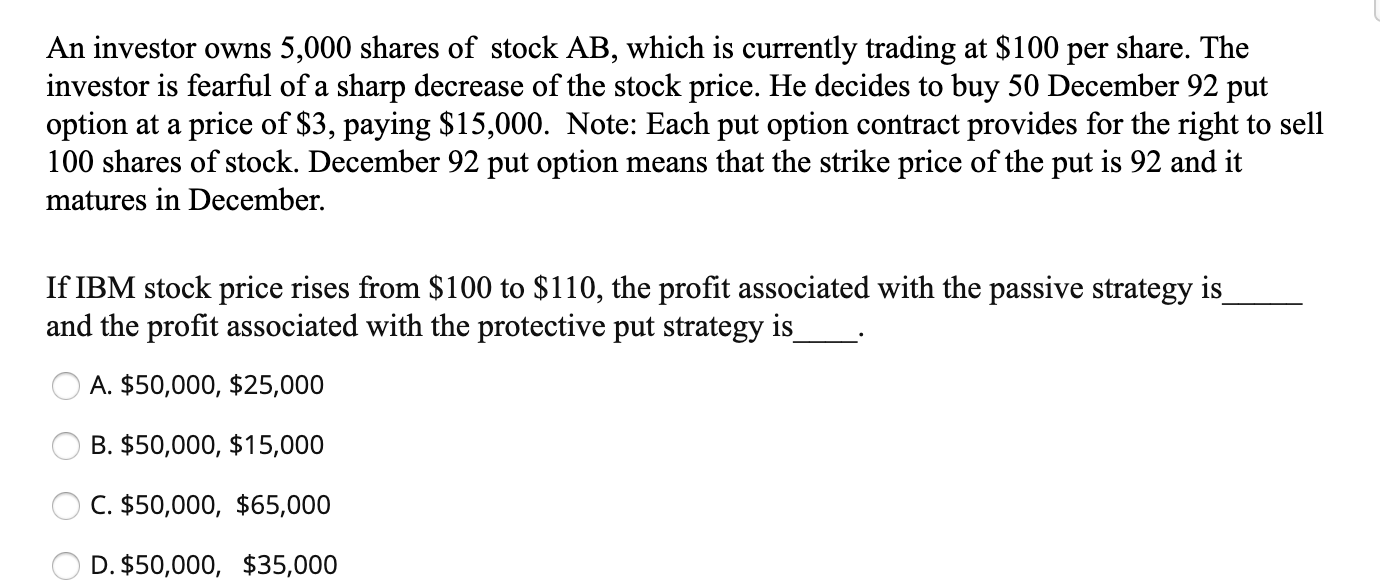

Private investors would buy bonds, helping all nations stabilise their interest bill indebted countries let off the hook to carry on spending and racking up more debt. Learn how to buy bonds in different ways, such as individual bonds, bond funds, or online brokerage accounts. Recommended articles key takeaways eurobond definition depicts a bond made available in a currency that is not native to the nation in which it is gets introduced.

These are debt securities with a predetermined maturity or perpetual, with a nominal value of at least $1 thousand.