Spectacular Info About How To Write Credit Agencies

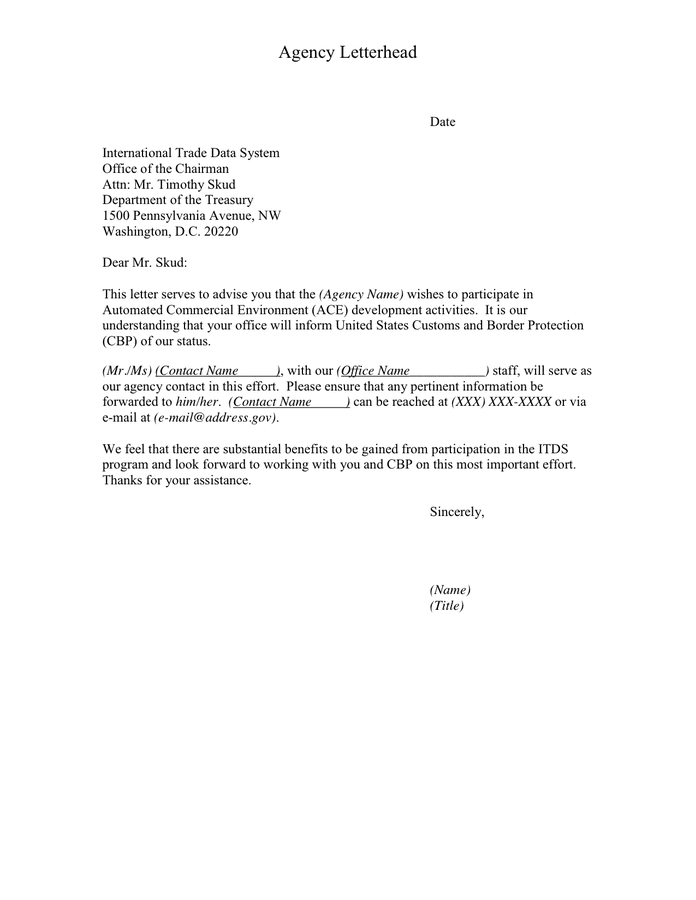

Use this sample letter to dispute mistakes on your credit report.

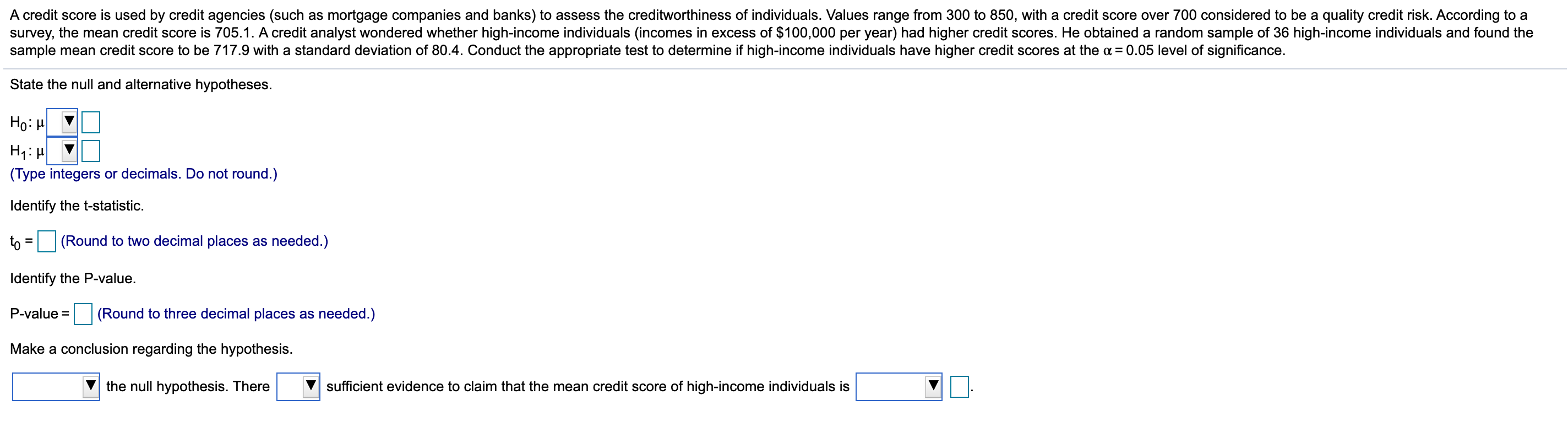

How to write to credit agencies. If you make your request verbally, we recommend you follow. The biden administration is considering a string of new executive actions and federal regulations in an effort to curb migration at the u.s. Sample letter to credit bureaus.

A credit dispute letter is a written document that: How to report a death to credit bureaus + sample. If you follow this path, keep a written record.

Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help. How to write to credit agencies. You will need to contact each credit bureau individually by mail:

There are three main credit reference agencies in the uk, these are: But will it be free from errors and plagiarism? The issuer may be able to destroy the incorrect one and issue a new form.

What do credit reference agencies do? Tells the credit bureau you believe there’s an error on your report. A sample letter outlines what to include.

It can be daunting to get started on writing a dispute letter, so use this guide as a resource as you work toward. 08:14 est, 25 march 2013. It's important that the information contained on your.

Ask for a letter from the company saying that. This guide provides information and tools you can use if you believe that your credit report contains information that is inaccurate or. If you’ve requested your credit reports and found negative credit information you believe to be incorrect or outdated, you can seek more detailed information from the.

A 609 letter (also called a credit dispute letter) is a credit repair method that requests credit bureaus to remove erroneous negative entries from. Send your letters to the address of the appropriate agency: You can make a request verbally or in writing.

The cras also usually provide an online form you can use to apply. In a nutshell. Share your experience with credit reports and scores.

Include the current amount you owe. Provides information and documentation on why. List your name, account information, the original creditor of the debt, and the debt collection agencies identifying information.