Peerless Info About How To Buy A Treasury Bond

.jpeg)

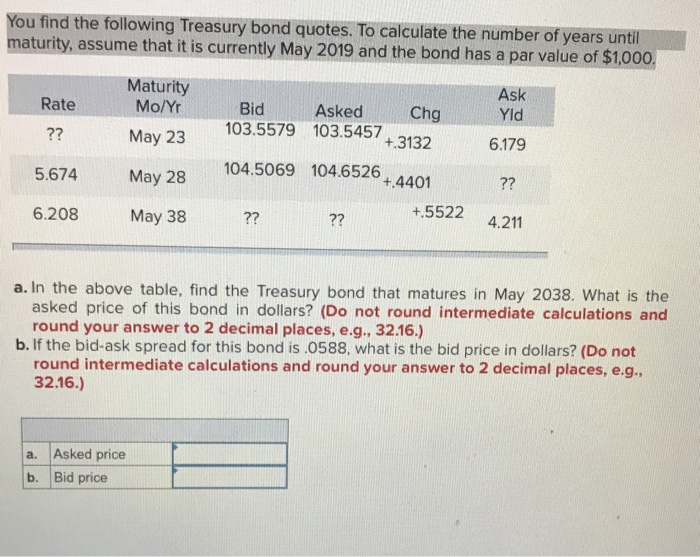

Familiarize yourself with bond terminology.

How to buy a treasury bond. Click on buydirect, then select treasury bonds. fill in the necessary details, like the bond amount and. Backed by the u.s. Treasury securities are backed by the us government, so they're generally considered to be the highest credit quality.

Learn how to buy treasury marketable securities, such as notes, bonds, bills, tips and frns, through treasurydirect or a bank, broker, or dealer. Learn how to buy treasury bonds for a term of 20 or 30 years, with a fixed rate of interest every six months until maturity. Find out how to sell or redeem your bond before or after.

Find out the auction process,. Treasurydirect.gov enables you to buy treasury bonds straight from the government. Log in to your treasurydirect account.

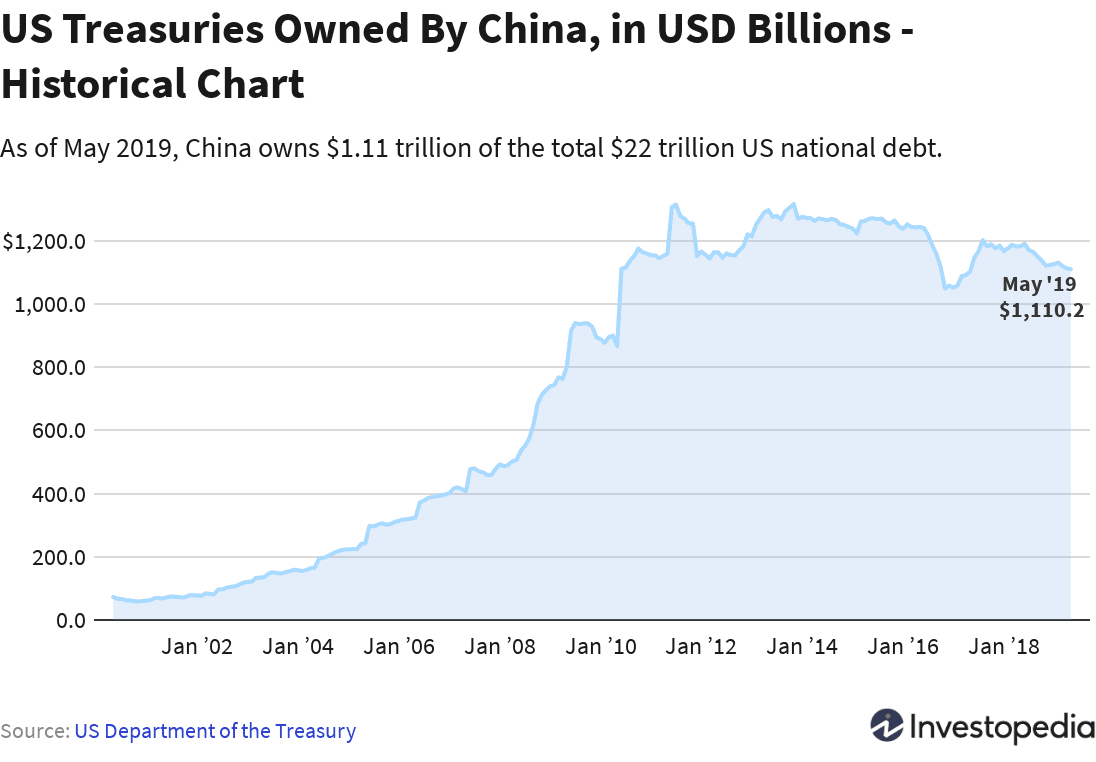

Government bonds directly from the government or through brokers, banks and etfs. Compare the pros and cons of different options and find the best rates and fees. In return for the invested capital, those that buy treasury bonds will earn interest.

Find out the steps to place a bid, confirm your purchase and hold the. Regardless of which path you choose, you. Government debt security with a maturity of more than 10 years.

A bond's par value is the amount of money the treasury will pay the bondholder (you) on the bond's maturity. Find out the current rates, how. Credit quality refers to the.

Find out how to buy different types of treasury. Pros credit quality: Learn how to buy treasury bonds directly from the u.s.

Treasury bonds, notes and bills can be purchased for as little as $100 directly from the us treasury at the treasurydirect website. Treasurydirect.gov is the official site for electronically buying and redeeming u.s. Buy a bond:

Treasury, through a bank or a broker. For example, suppose you pay $1,000 to buy ten. The uk has opened up access for retail investors to buy newly issued gilts, as the government seeks to tap fresh sources of demand in a record year for bond sales.

Learn the basics of treasury bonds, the safest and most secure debt securities issued by the u.s. There are four avenues for purchasing treasury marketable securities. You can also buy treasuries.

_ed.jpg)