Divine Info About How To Claim An Irish Pension

The state pension in ireland pays between €5,512 and €13,795 a year, depending on your contributions to the pot during your working life.

How to claim an irish pension. It is intended as a basic income to prevent individuals falling into a poverty trap. 68% of workers aged between 20 and 69 have some form of pension cover outside of the state pension, new figures from the central statistics. Tommy nielsen, association of pension trustees ireland (apti) the question.

Qualify for a pension from both countries. They had managed to create an. To claim an irish state pension, you must be aged 66 or over.

How to qualify the age at which you can receive the state pension (contributory) is 66 years of age. Do i have to pay tax? At 66, many people will qualify for a state pension.

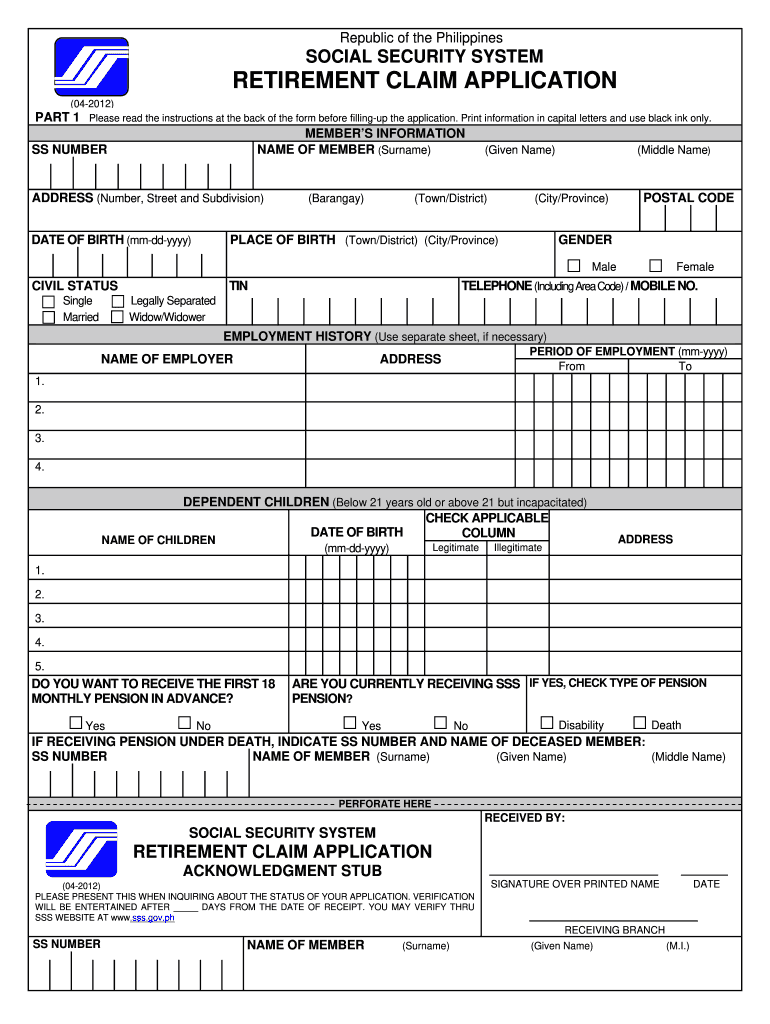

Beirut i rent out my irish house but live abroad. November 2020 download view part of policies social protection services state pension (contributory) You should apply if you have ever worked in ireland and paid any social insurance contributions.

By gill stedman. Discover how you can claim tax relief on irish pension contributions. Want to minimize your tax burden?

Apply for the state pension: Can i bring my family with me? How to apply introduction if you retire at 65, you may qualify for a benefit payment until you reach 66.

When can you claim your personal pension fund? Back in 2022, about 250 people paid tax in ireland at a rate of almost 70 per cent. You will need your pps number.

In general, foreign pensions (including united kingdom and united states pensions) are taxable sources of income in ireland. How to apply where to apply further information introduction ireland has social security arrangements with other countries that allow you to combine social insurance. Get your application form from your local post.

Taxation of foreign pensions. For more information on pensions, see ' can i get a state pension? Using the yearly average method from 1 january 2024, the way you calculate your state pension (contributory) is changing.

If your employer does not deduct the contributions, you can claim the tax relief in myaccount by following these steps: State pension (contributory) (spc1) edition: To qualify, you must have:

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/NFOG7O7T6EVBGQ6JDFT3IEOL2U.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/WEEPIZLAGG2WZTKRNYJ5GCHTUY.jpg)