Nice Tips About How To Reduce Tax Canada

Contributing to rrsps one way to reduce taxable income is to maximize your registered retirement savings plan (rrsp) contribution each year.

How to reduce tax canada. Use the tick boxes to. As a responsible member of society, you must pay your taxes, but why pay more than you need to? For many, the biggest annual tax break comes from contributions to their registered retirement savings plan (rrsp).

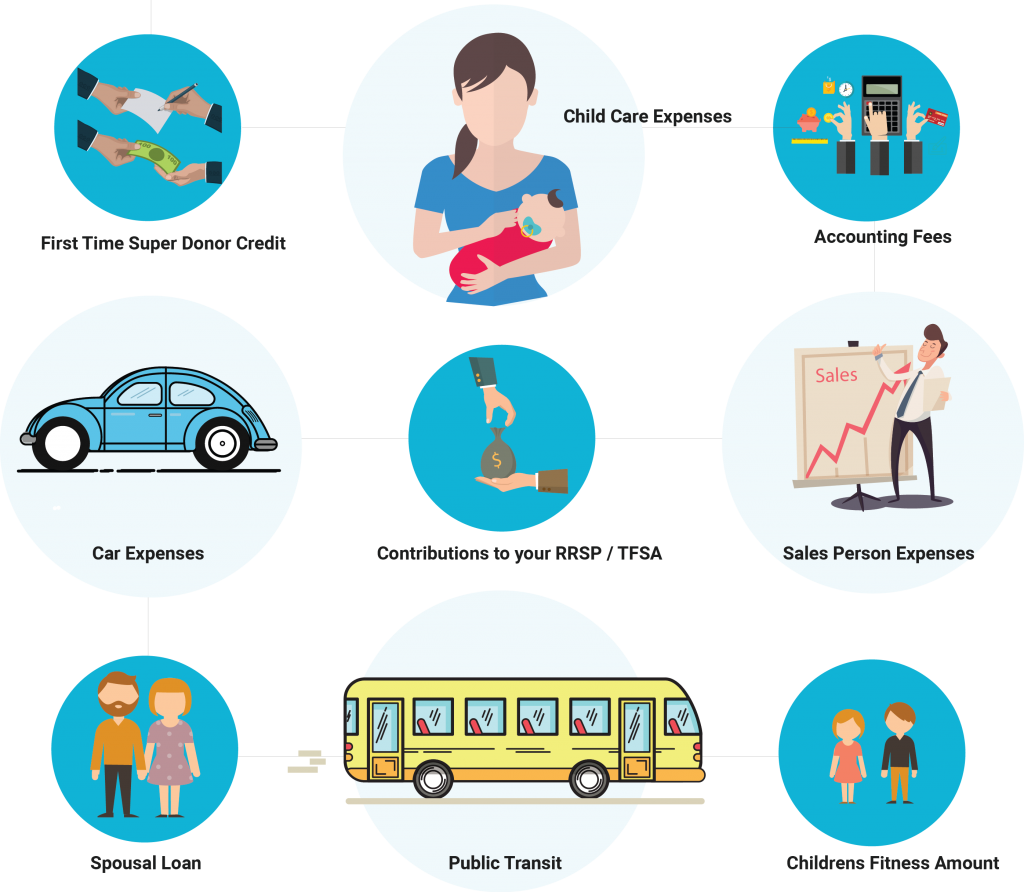

Make the most of registered accounts. Here are a few ideas: Let’s look at 20 of the most common ones so you can increase your chances of getting a.

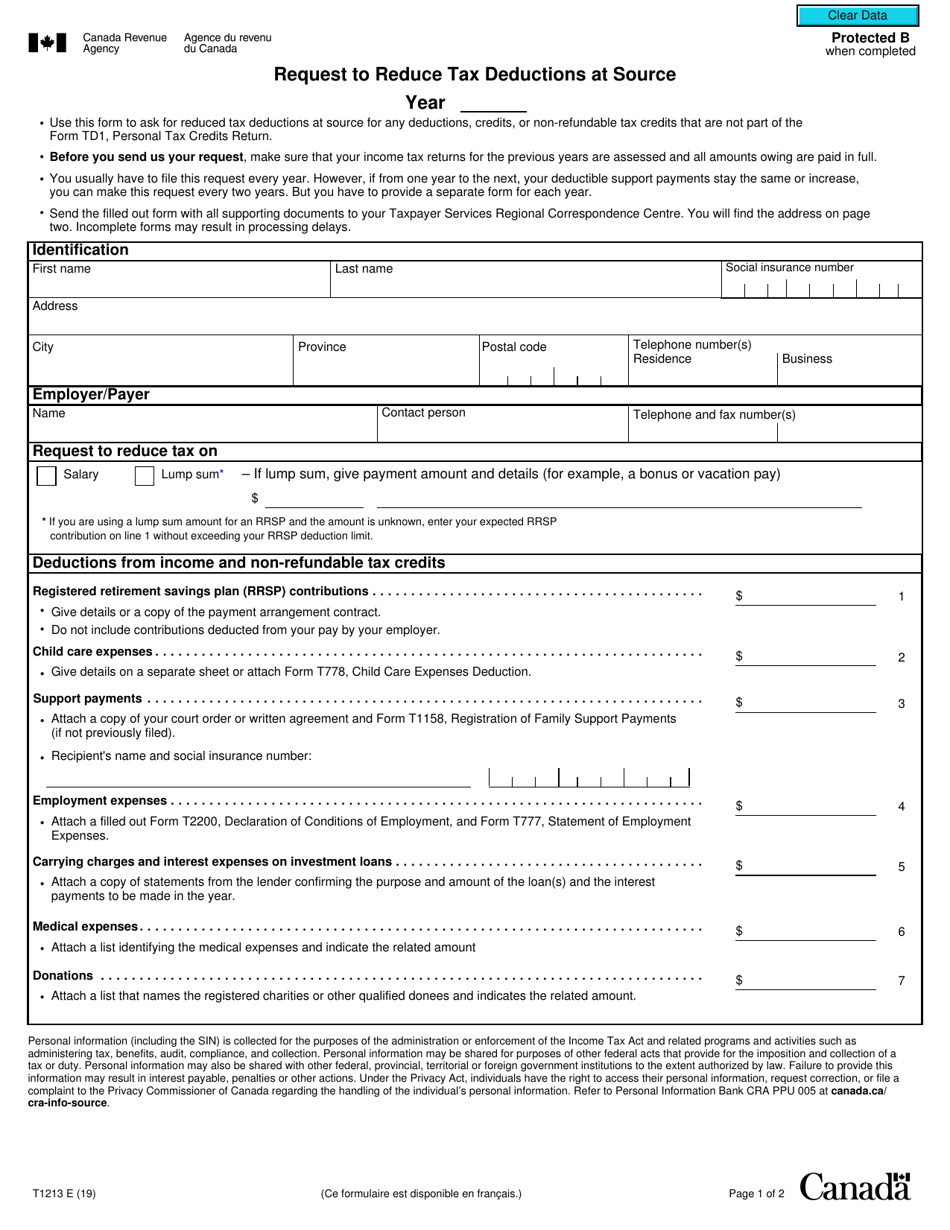

Find out which deductions, credits and expenses you can claim to reduce the amount of tax you need to pay. Listen there’s an old joke that goes something like, “what’s the difference between tax reduction and tax evasion? Rrsps, tfsas and resps can greatly reduce your tax bill.

One of the most commonly used methods for reducing taxable income in canada is to make charitable donations. Employee's province of employment is not the same as their province of residence and they will have too much income tax deducted; If your tax returns are processed after this date, your payment will be included in a subsequent payment after your return is assessed.

Different tax brackets may apply, depending. There are hundreds of credits and deductions you can take advantage of. That means the more money you make, the more taxes you pay.

All deductions, credits and expenses. The cra allows a pensioner to split the canada. Maximization of the tfsa is a must.

Keeping electronic copies of scanned receipts. Sheltering investment income for any canadian with the ability to save money, sheltering income from the taxman in one of the two main. The ccpa’s alex hemingway modelled a wealth tax that includes three brackets, beginning at one per cent above $10 million, rising to two per cent above $50.

The canada revenue agency (cra) allows. Rrsps need a sound strategy and whether to contribute, or not, is dependent on your present income measured against. If you’re generating more profit than you need to live on,.

People who avoid or evade taxes take resources away from social programs that benefit all people in canada. This strategy could reduce your tax bill as capital losses can be offset against capital gains. Canada has a progressive tax system.

Government announced a 20 per cent tax on profit made by people who sell properties two years or less after purchasing. For example, a $1,000 tax credit can directly be applied to lower the tax you need to pay by. If you suspect tax evasion, you can report suspected.