Supreme Tips About How To Claim House Tax Credit

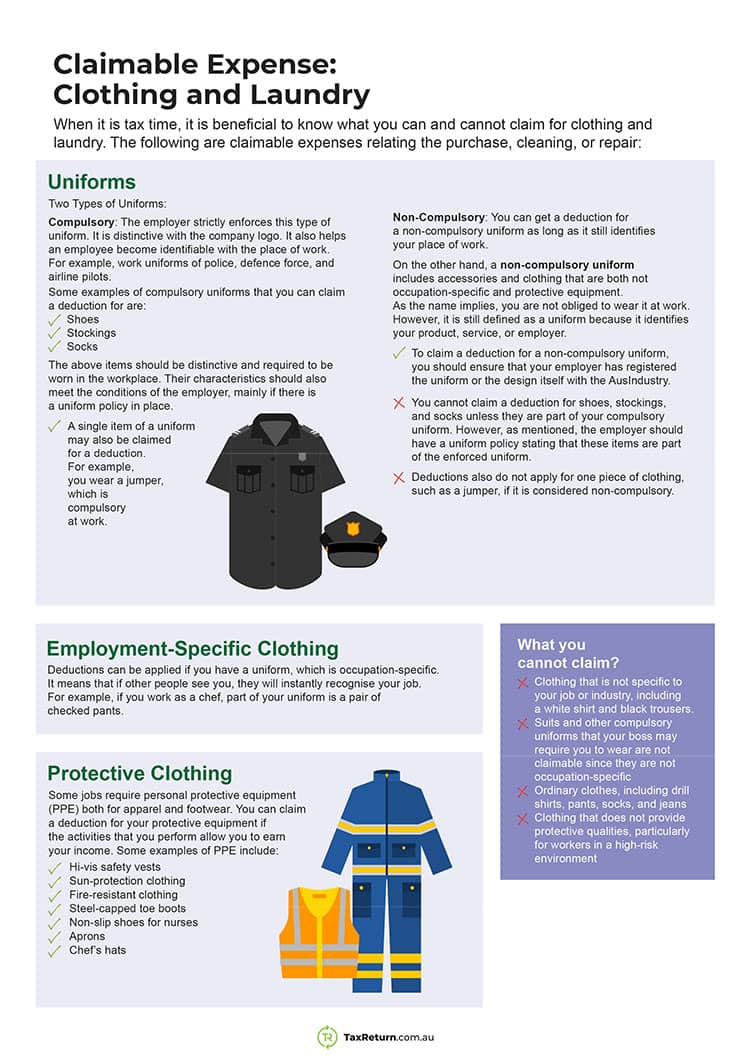

You may claim this credit for improvements to your primary home.

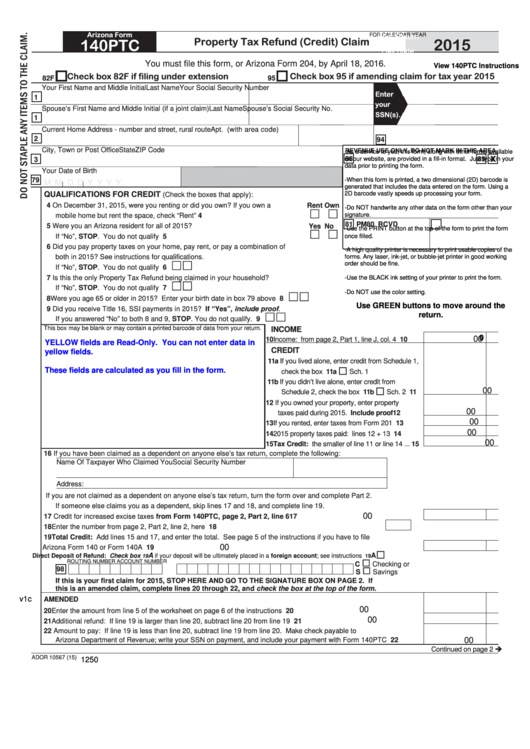

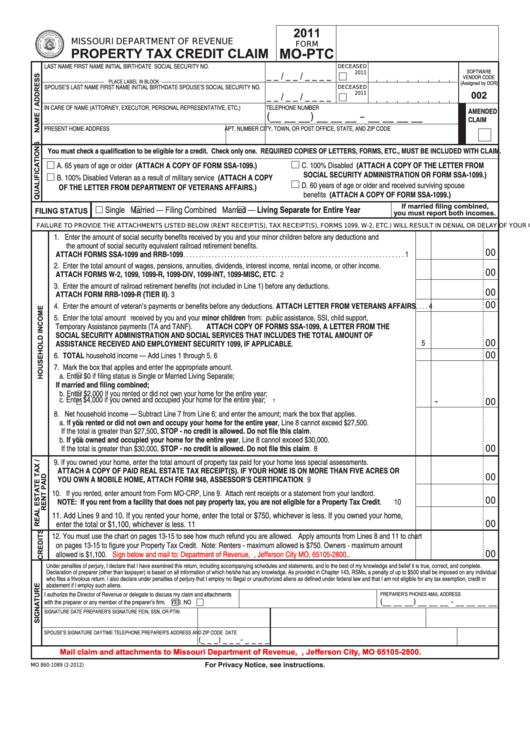

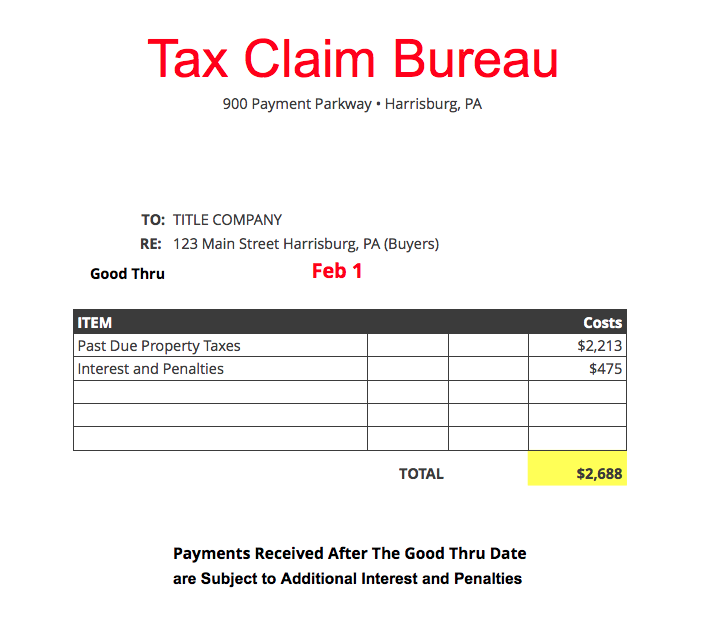

How to claim house tax credit. If you just bought a house, you may be able to deduct: For the tax year 2024, to. A taxpayer may not claim the credits until the year the property is installed.

For the tax year 2023, it would increase to $1,800; *guaranteed by column tax are property taxes deductible?. Are there any requirements for how long the property must remain in use.

The credit percentage drops to 26% for property installed in 2033 and 22% for property installed in 2034. The value of the hbtc is calculated by multiplying. The credit applies for property placed in service after december 31, 2021, and before january 1, 2033.

So, if you made any qualifying home improvements to your. Joint claims backdate a claim what counts as income work out your hours how to claim tax credits have been replaced by universal credit. Property tax deduction:

Mortgage interest (including points) property (real estate) tax. Making these upgrades together in one year would allow you a tax credit of up to $1,200 for the insulation and up to $2,000 for the heat pump. A $1,000 tax credit would reduce their total tax bill to $9,000.

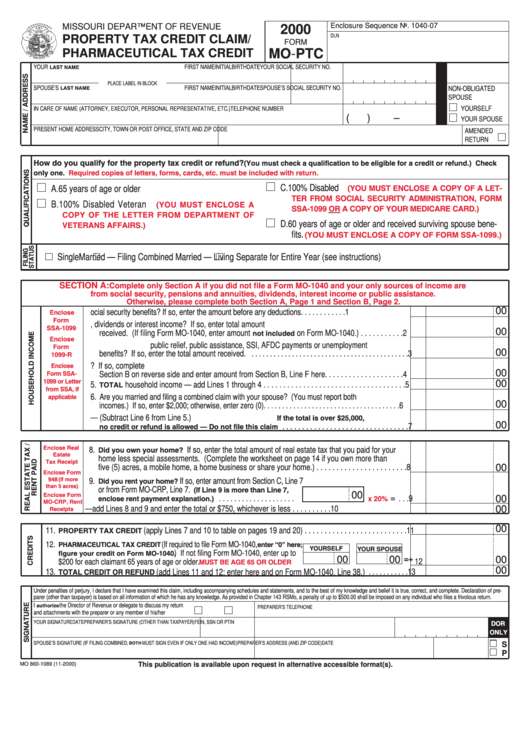

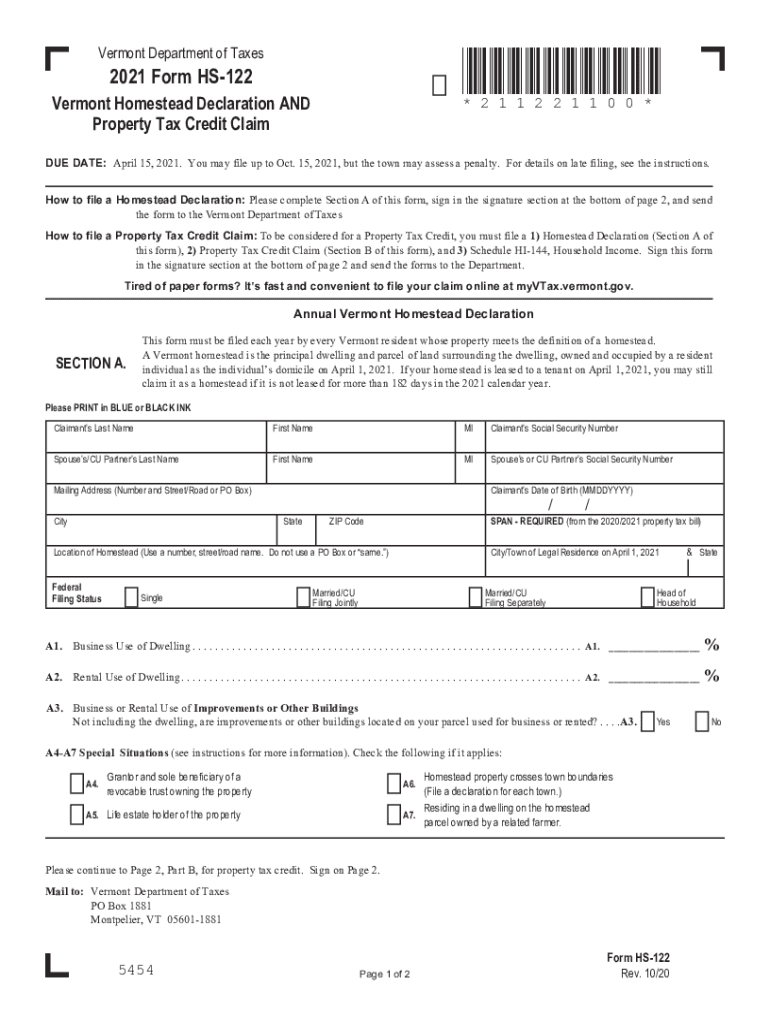

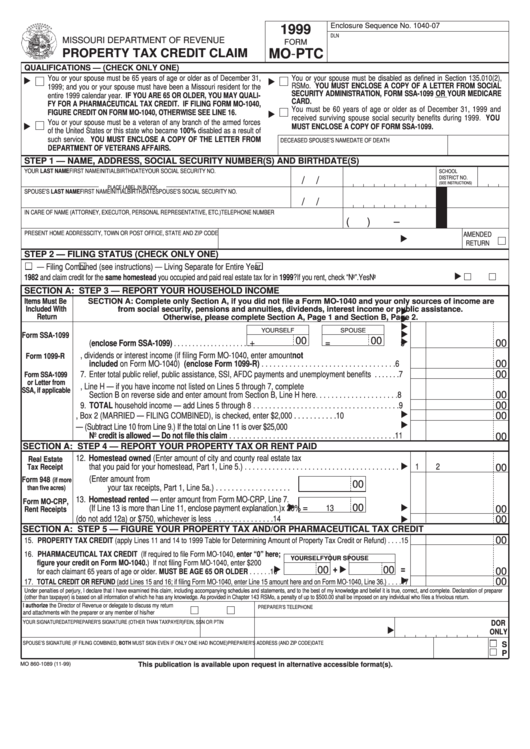

How do i claim the credits? Here’s how to claim your hvac tax credit when you file your federal income tax return: These include real estate taxes,.

Only a portion is refundable this year, up to $1,600 per child. Eligible home buyers may use their tax credit once only. The maximum tax credit available per kid is $2,000 for each child under 17 on dec.

You can claim either the energy efficient home improvement credit or the residential energy clean property credit for the year when you make qualifying improvements. Similarly, you could combine a heat. Solved • by turbotax • 1722 • updated 2 weeks ago.

Review all deductions, credits, and expenses you may claim when completing your tax return to reduce your tax owed family, child care, and caregivers deductions and. Yes, but if the residence where you install a solar pv system serves multiple purposes (e.g., you have a home office or your business is located in the same building), claiming the. The new rules would increase the maximum refundable amount from $1,600 per child.

You can only make a claim for. Installing renewable energy equipment on your home can qualify you for residential clean energy credit of up to 30% of your total qualifying cost, depending on the year the. 1 you may think, o h, good, i don’t pay that much for property.