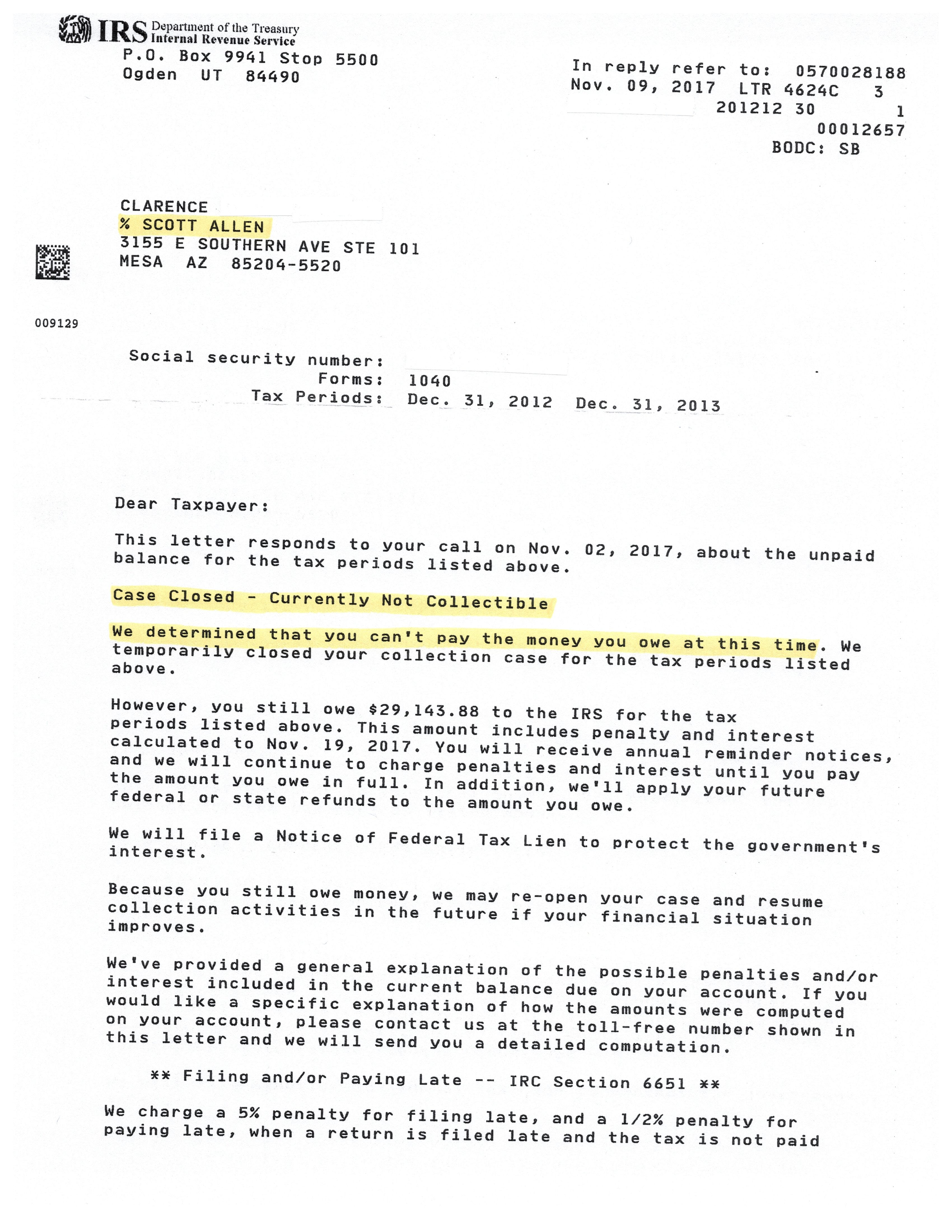

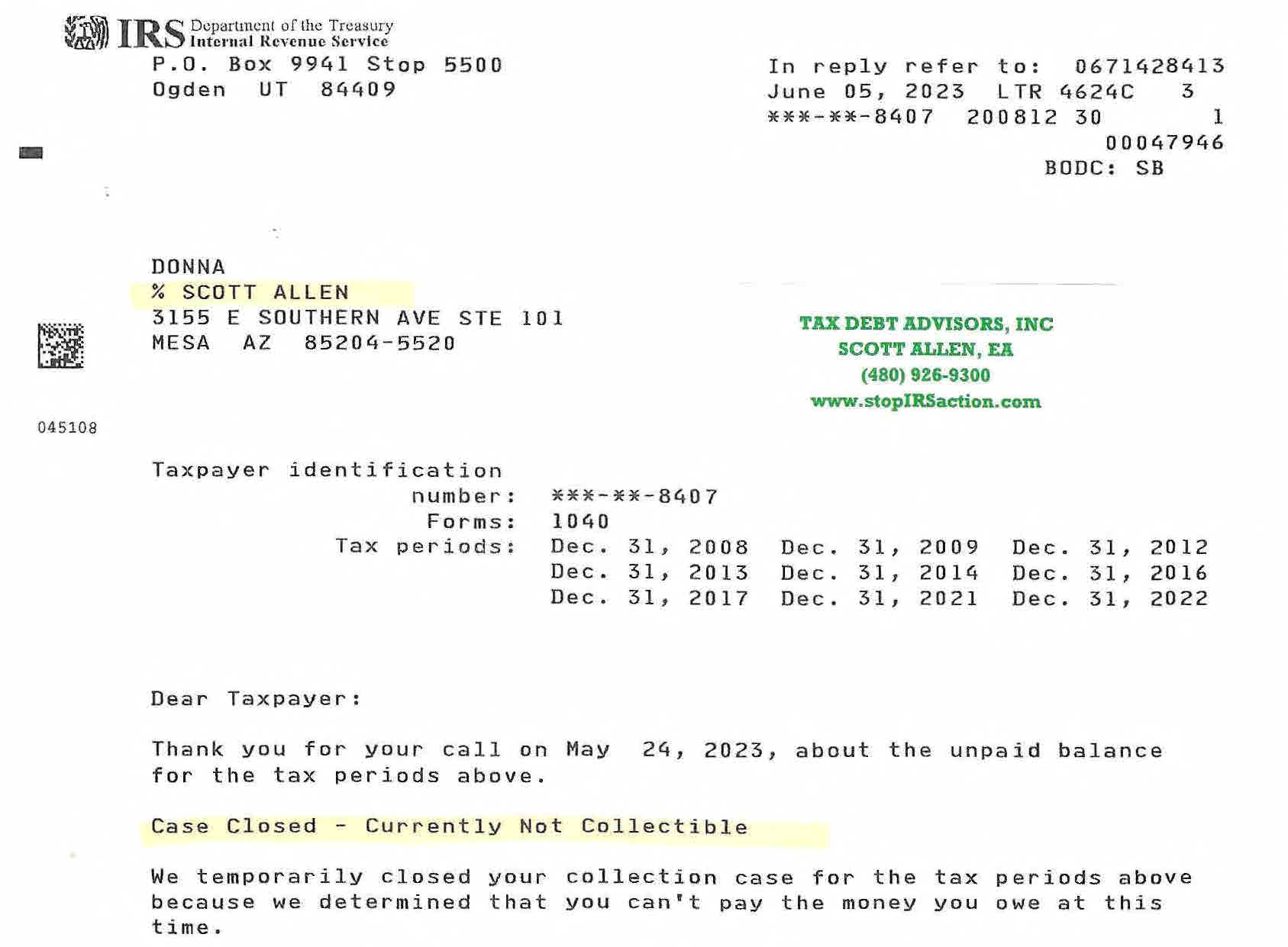

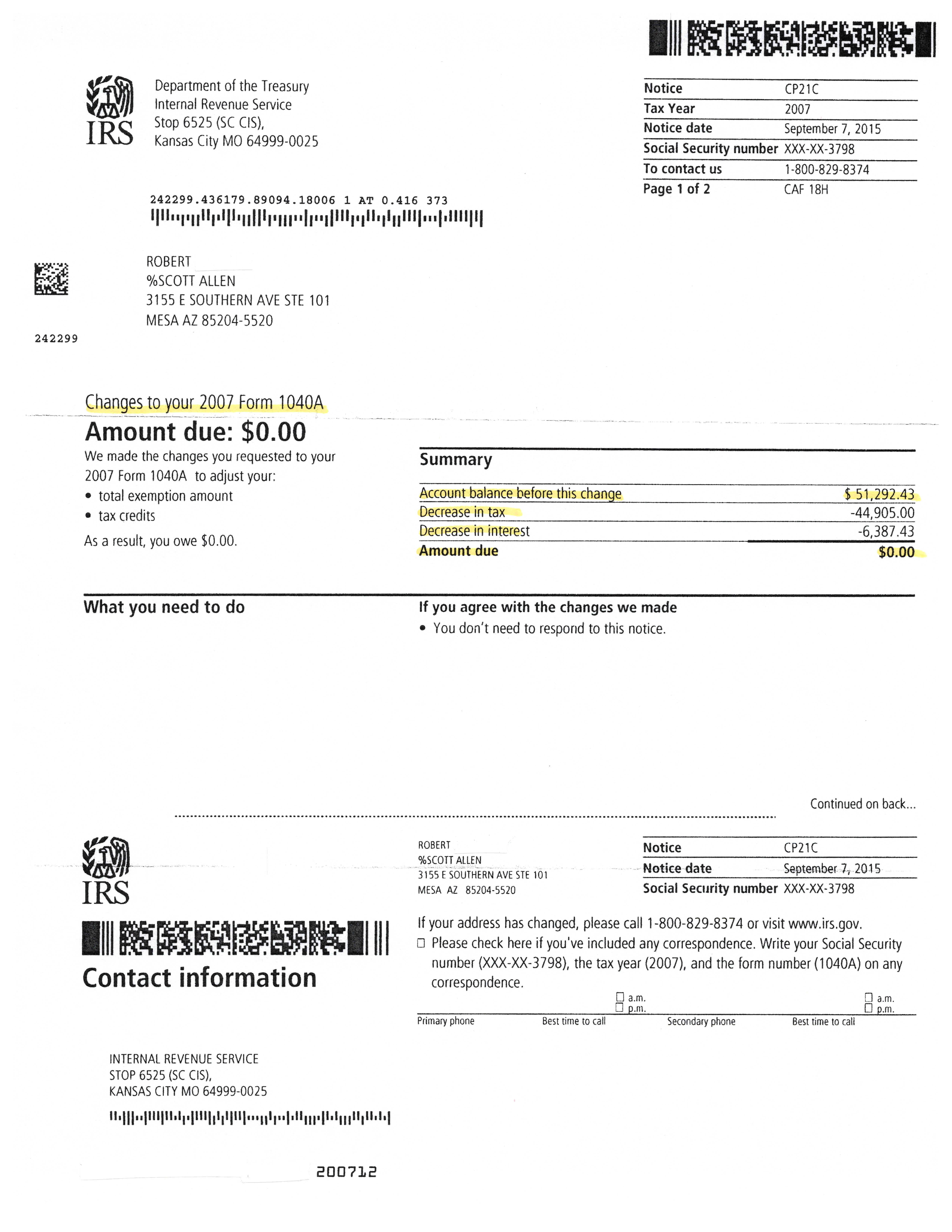

Formidable Tips About How To Stop Irs Levy

Are there different types of tax levies?

How to stop irs levy. An irs tax levy can put your property and. If you don’t have the money on. Table of contents skip to section.

Find out the options for resolving tax debt, such as installment. Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help. 2what is a tax levy?

If you’ve received a tax levy notice from the irs or if you’re wondering how to stop a state tax levy, you have several helpful options to consider. What is it and how can you stop it? Find out the steps to avoid,.

January 19, 2022 | last updated: How to stop irs tax. You can cancel your hearing if you get the problem cleared up before then.

Home > get help > interacting with the irs > levies. You can avoid a levy by filing returns on time and paying your taxes when due. If you don’t contest (disagree with) the tax bill, the best way to remove the levy is to pay the past due amount.

Here’s how to stop a tax levy. Easy article navigation hide. In most cases, as long as you reach out, the.

How to stop the irs levy if you agree with the tax bill. 4apply for an installment payment agreement. If you need more time to file, you can request an extension.

You can stop all irs collection actions by paying your outstanding tax debt in full, including your back taxes, penalties, and interest. If you can’t pay what you owe, you should pay as much as you can and work with the irs to resolve the balance. Learn how to comply with an irs levy that has been issued to your property, such as wages, bank accounts, vehicles, or real estate.

Depending on your situation, you can set up a payment arrangement, seek other relief, or appeal in order to stop an irs levy. How to stop irs tax levy on wages from your paycheck. 3ways to stop a federal tax levy.

You can stop the levy before your money goes to the irs by requesting a payment extension that lets you pay off the debt within 120 days. 3pay the full amount due. Remember, the irs cannot garnish your wages or levy your bank account while the appeal is pending.