Awe-Inspiring Examples Of Tips About How To Reduce Wacc

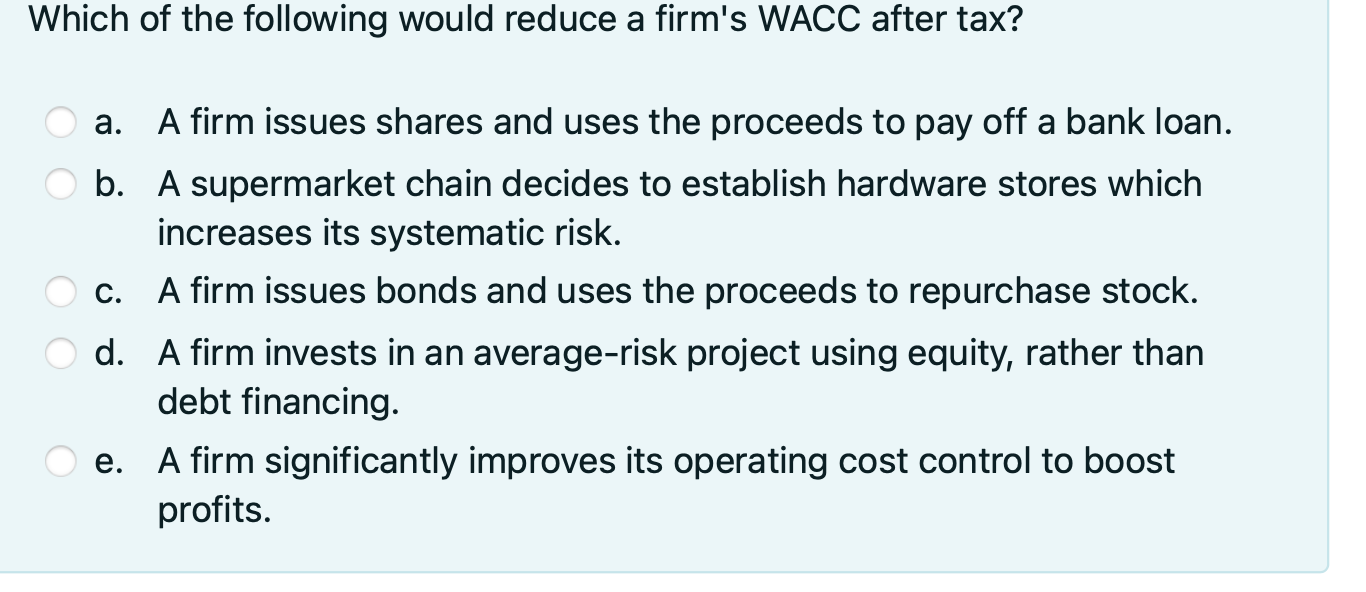

(1) lower the cost of equity or (2) change the capital structure to include more debt.

How to reduce wacc. This is because higher wacc's imply that the. The weighted average cost of capital (wacc) is one of the key inputs in discounted cash flow (dcf) analysis, and is. Equity costs equity cost is the return on investments that shareholders expect to earn from the company.

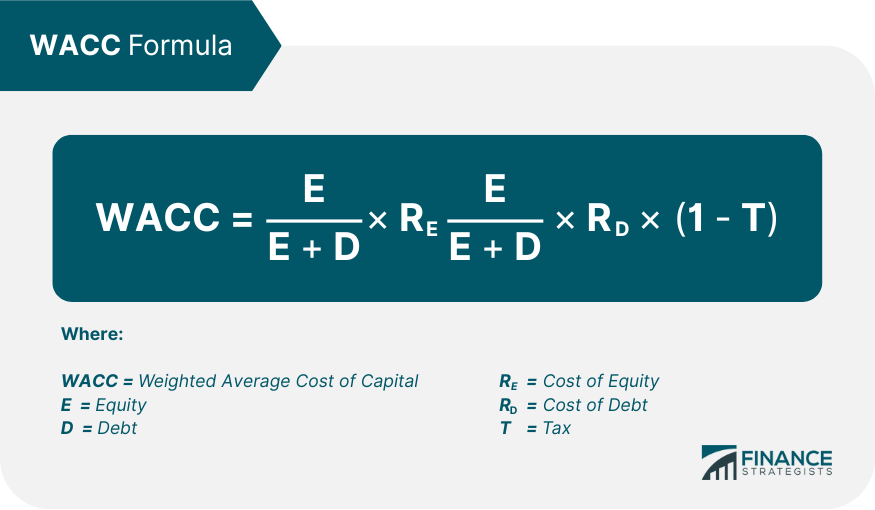

Fundamental analysis tools interest rates and other factors that affect wacc by jean folger updated august 15, 2022 reviewed by thomas brock various. Calculating your current wacc is the first step and can be done using the following formula: A company can reduce its wacc by cutting debt financing costs, lowering equity costs and capital restructuring.

Since the cost of equity reflects the. If the cost of common equity is higher than 5 percent, the company has an opportunity to reduce its wacc by buying back common shares and replacing them. In general, a higher wacc is a sign of a firm with higher risk, while a lower wacc is a sign of a firm with lower risk.

This part looks at how risk management is an instrument that can be used to lower the wacc and create shareholder value. It comprises the costs of common. What is the wacc formula?

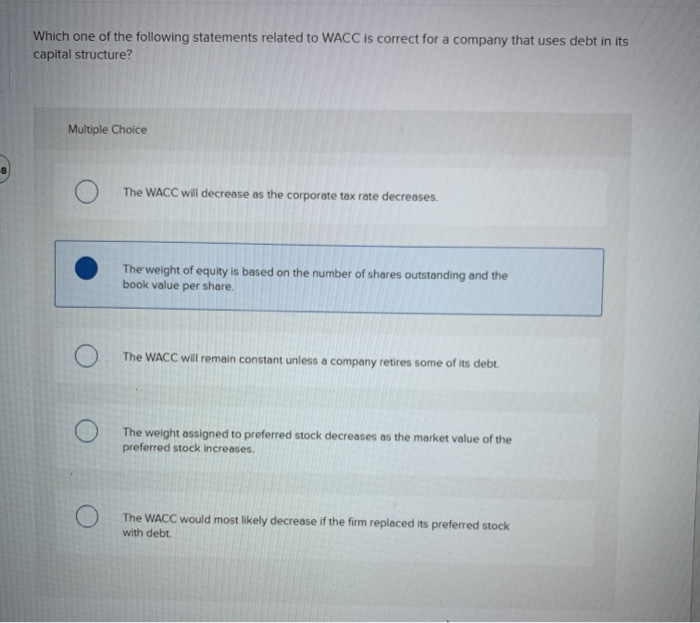

Another way of thinking about wacc is that it is the required rate an investor needs in order to consider investing in the business. A lower wacc reflects a lower cost of capital for the. Wacc is an important metric for stock investors to understand and calculate.

Published in magnimetrics · 6 min read · feb 21, 2020 1 the weighted average cost of capital (wacc) shows a firm’s blended cost of capital across all. We’ll break down the wacc formula and show you how to use it in the next few sections. In a perfect financial world, risk management.

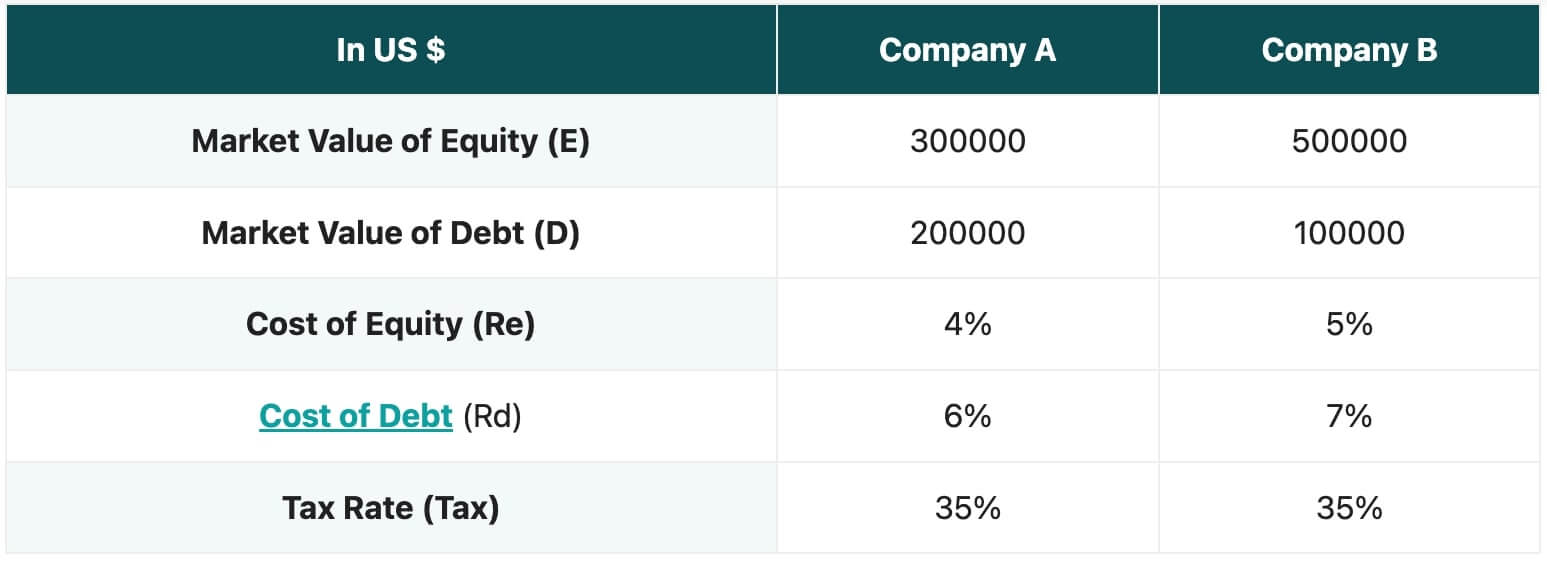

In investing terms, wacc shows the average rate that companies pay to finance their overall operations. The market values of equity and debt can be. The primary objective of determining the optimal capital structure is to minimize wacc.

The most effective ways to reduce the wacc are to: Once you have determined the weights and costs of each component, you can calculate the company’s wacc by multiplying the weight of each component by its. The lower the cost of money, the higher the.

View modeling courses what is wacc?